Super Micro Computer Inc (NASDAQ:SMCI) shares are trading lower Tuesday, caught in a downdraft affecting the broader semiconductor and high-growth technology sectors. The sell-off was fueled by a combination of profit-taking in artificial intelligence related stocks and mounting pressure from rising U.S. Treasury yields.

What To Know: The surge in long-term interest rates, with the 10-year Treasury note yielding 4.29%, has made investors reassess the high valuations of growth-oriented companies. Higher yields diminish the present value of future earnings, disproportionately impacting high P/E stocks like Super Micro. This market-wide anxiety was compounded by a general cooling in the semiconductor sector, as investors opted to secure gains following a period of strong, AI-driven performance.

Adding to the headwinds, Super Micro has been contending with company-specific issues. The server maker recently reiterated that it had identified “weaknesses in its financial disclosure controls” which could hinder its ability to deliver timely and accurate financial results.

This followed a weaker-than-expected fourth-quarter report and soft forward-looking guidance. Despite these challenges, the stock remains up over 30% year-to-date, largely benefiting from its key partnerships with tech giants like Nvidia Corp and its central role in the expanding AI infrastructure market.

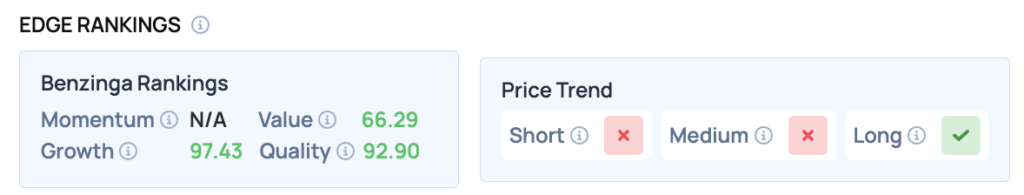

Benzinga Edge Rankings: Despite its negative short-term price trend, Benzinga Edge highlights the company’s exceptional underlying fundamentals, awarding Super Micro a Growth score of 97.43 out of 100.

Price Action: According to data from Benzinga Pro, SMCI shares are trading lower by 3.66% to $40.02 Tuesday. The stock has a 52-week high of $66.44 and a 52-week low of $17.25.

Read Also:

How To Buy SMCI Stock

By now you're likely curious about how to participate in the market for Super Micro Computer – be it to purchase shares, or even attempt to bet against the company.

Buying shares is typically done through a brokerage account. You can find a list of possible trading platforms here. Many will allow you to buy “fractional shares,” which allows you to own portions of stock without buying an entire share.

If you're looking to bet against a company, the process is more complex. You'll need access to an options trading platform, or a broker who will allow you to “go short” a share of stock by lending you the shares to sell. The process of shorting a stock can be found at this resource. Otherwise, if your broker allows you to trade options, you can either buy a put option, or sell a call option at a strike price above where shares are currently trading – either way it allows you to profit off of the share price decline.

Image: Shutterstock