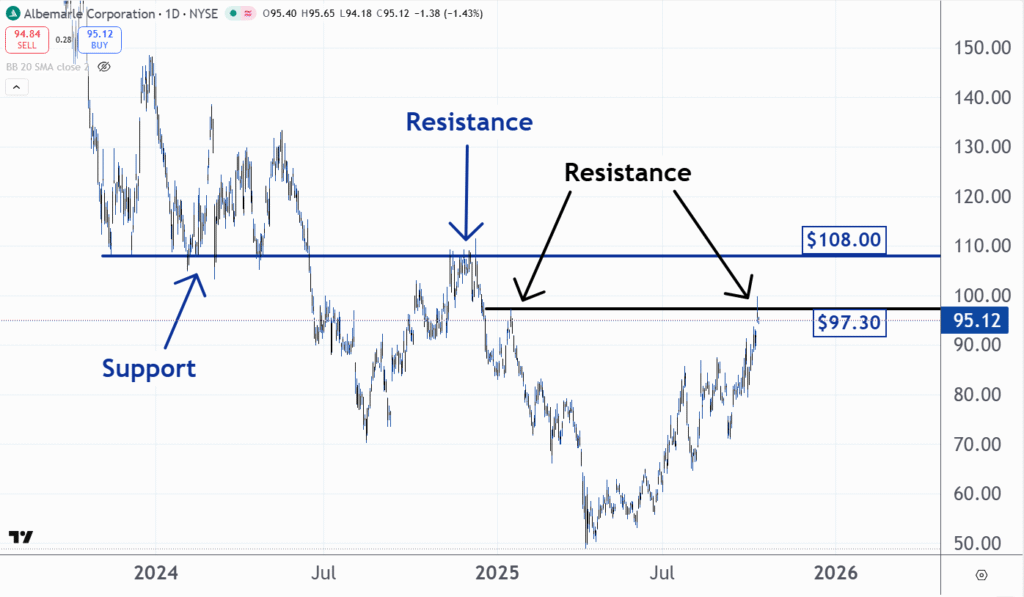

Trading in Albemarle Corporation (NYSE:ALB) is quiet Friday. The stock has stalled at a resistance level.

There is a good chance it reverses and heads lower. This is why Albemarle is the Stock of the Day.

• ALB is feeling the pressure from bearish momentum. Take a look here.

Resistance is a price level or narrow price range where there is a large number of shares for sale.

If a stock is moving higher, it is because there is more demand or shares to be bought than there are for sale. Buyers need to step ahead of and outbid each other if they want to attract sellers.

This forces the stock into an uptrend.

Read Also: Trump’s Fed Chair Shortlist Narrows To Five Doves: Who Are They?

At a resistance level, the situation changes. There is enough or more than enough supply to satisfy all of the demand. This is why uptrends end or pause when they reach resistance.

One of the main reasons why resistance forms in markets is due to remorseful buyers. These are people who regret their decisions to buy after the price drops. Some vow to hold onto their losing positions, but they also decided to get out at breakeven if they can eventually do so.

As a result, if the stock returns to their buy price they place sell orders and this can create resistance. It can be seen on the chart of Albemarle.

The $108 level was support for the stock from November 2023 through April 2024. When this support broke and the price dropped, many of the people who bought at the support decided to sell if it returned to their buy price.

When the stock returned to $108 in November 2024, they placed sell orders and this created resistance.

In January 2025, Albemarle found resistance at $97.30. When the price dropped after, some of the people who bought stock at the peak came to regret doing so. They decided to sell at breakeven if they eventually could.

When the stock got back to this price yesterday, they placed sell orders and this formed resistance.

Markets are driven by psychology. Buyer remorse can turn what was support into resistance. It can also keep resistance intact. If traders know where resistance will be, they can plan successful exit strategies.

Read Next: Silver’s Explosive Move May Be Yet To Come, Analysts Say

Photo: Shutterstock